The financial landscape is experiencing a monumental shift, one that could potentially redefine our approach to transactions. As we move further into the digital age, the era of paper money—a dependency we’ve carried for a millennium—is gradually ending. The harbinger of this transformation is the advent of real-time payments (RTP), a concept that offers a digital cash equivalent and enables people to conduct transactions instantly, altering the dynamics of global commerce.

The Advent of Real-Time Payments

Real-time payments or Instant Payments (IP) are leading the charge in reshaping financial transactions. These enable instantaneous transfer of funds among individuals, businesses, and governments, accompanied by immediate confirmation. This technological innovation is simplifying global commerce, and more importantly, it’s happening right now.

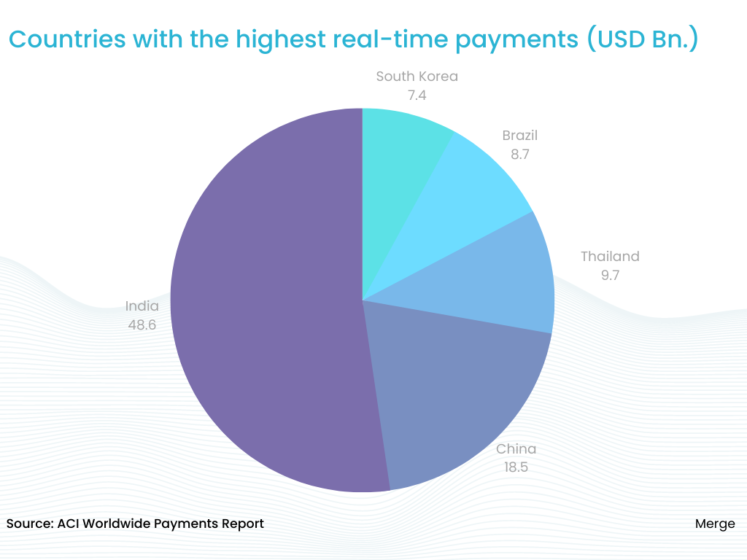

A 2020 report by ACI Worldwide crowned India as the real-time payments leader. Out of the global tally, India accounted for 25.5 billion transactions, comfortably surpassing heavyweights like China, South Korea, the UK, and the US. This signals a new phase in the worldwide adoption of digital payments.

The Market Potential of Real-Time Payments

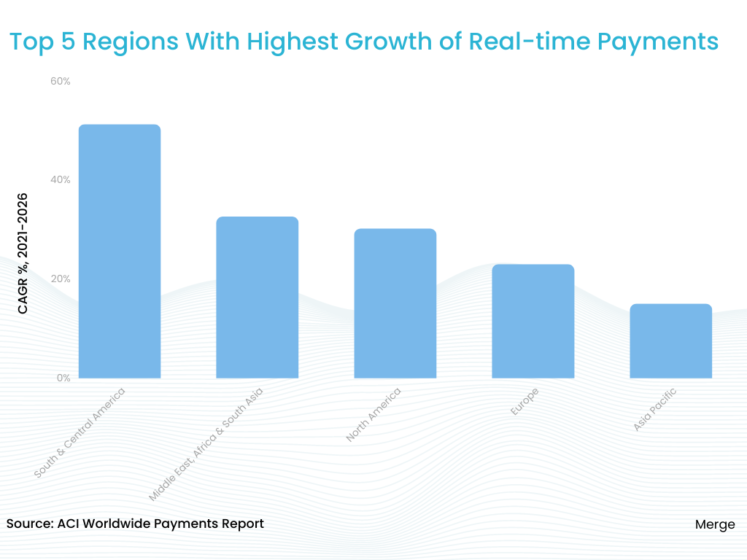

The rise of real-time payments has opened up enormous market potential. In 2022, the global real-time payments market stood at a staggering US$17.57 billion. This market size is poised for massive growth, with a predicted compound annual growth rate (CAGR) of 33.0% from 2021 to 2028.

The advantages of RTP are multifold, offering faster payments and more consistent methods compared to legacy techniques, which could take days to reach a recipient. This development represents a new, more efficient, and seamless way to make financial transactions, creating waves of transformation with far-reaching cultural, social, and economic implications.

The COVID-19 Effect on Real-Time Payments Systems (RTPS)

The COVID-19 pandemic, a global catastrophe, has unexpectedly become a catalyst, accelerating the transition to digital and real-time payments worldwide. This phenomenon was particularly visible in India, which witnessed an overhaul in payment behaviour, with contactless payments becoming the norm, powered by the real-time nature of these transactions.

This surge in digital transactions was partly due to a suspicion towards cash as a potential virus carrier. While this suspicion lacked strong scientific backing, it nonetheless drove many towards digital transactions, paving the way for a possible transition towards a cashless society.

The Global Reach and Challenges of RTPS

The penetration and adoption of real-time payments have dramatically scaled in recent years. The evidence of its acceptance is clear when we compare the statistics of countries employing real-time payments. In 2015, there were only 14 nations with a real-time payment infrastructure in place. Fast forward to the present, and we find that this figure has expanded significantly, with 56 countries now utilizing real-time payments. This rapid growth signifies the transformative potential of real-time payments in global commerce, and yet the journey is far from smooth sailing.

The three fundamental types of real-time payment mechanisms have each contributed to the robust growth of real-time payments. These include traditional instant bank transfers, which use account numbers to facilitate transactions; RTP transfers, which employ an alias such as a mobile number or a unique ID to authorize payments; and e-wallets, which serve as digital repositories of funds from which payments can be made.

Despite their effectiveness in facilitating rapid transactions, these payment mechanisms present distinct challenges that can complicate their implementation and use. For traditional instant bank transfers, the limitations lie in the need for accurate bank account details, which can be cumbersome to enter for each transaction, making the process less user-friendly.

For RTP transfers, while the use of an alias like a mobile number or unique ID simplifies the transaction process, it also presents security concerns. Ensuring that these aliases cannot be easily hacked or duplicated is paramount to maintaining the integrity of RTP systems and preserving users’ trust.

E-wallets, on the other hand, face challenges relating to interoperability and regulatory oversight. As e-wallet services are often provided by non-banking institutions, navigating the regulatory framework can be complex. Further, interoperability between different e-wallet services can be limited, inhibiting a seamless transaction experience for users.

Financial institutions and payment service providers worldwide are confronting these challenges head-on, investing in advanced technologies and security protocols. They strive to remove friction from transactions, making real-time payments as simple and secure as possible. They recognize that to realise the full potential of real-time payments, these challenges must be effectively addressed and overcome. In this context, the rise of real-time payments serves as a testament to ongoing innovation in the financial services sector, even in the face of formidable challenges.

Benefits and User Segments of RTPS

Real-time payments bring transformative benefits far beyond the appeal of instantaneous transactions. They extend into domains such as revenue generation, customer engagement, fraud and risk management, and more. These innovative payment systems offer businesses a valuable tool to enhance cash flows, increase operational efficiency, refine budgeting practices, and manage cash assets more effectively. The ramifications of these advantages are not confined within the business sphere; they reverberate across all user segments, including governments and individual consumers. As a result, the traditional reliance on physical payment cards is being gradually phased out, replaced by the convenience and efficiency of real-time payments.

The impact of these benefits is particularly pronounced in the banking sector, where financial institutions in the U.S. are leveraging the RTP network to provide faster, safer payment processing services. In tandem with these developments, the Federal Reserve Banks have launched the FedNow service, an innovative real-time payment and settlement service. This service synergizes the functionality of clearinghouses to enhance overall transaction efficiency.

Future of RTPS

The rise of real-time payments marks a significant shift in global finance. Despite the challenges ahead, the benefits and potential impacts of instantaneous transactions are undeniably transformative. From enhancing commerce to revolutionizing the way individuals, businesses, and governments manage funds, the revolution is just beginning. As we navigate these changes, one thing remains clear: the future of finance is in real-time payments, creating a world where transactions are instant, seamless, and efficient. Indeed, we stand at the dawn of a new era in global finance, one where real-time payments take center stage.