Despite the over-glorification of decentralized finance and web3, the reality is much more prosaic. Money has always been and will remain a means of exchange of value, whatever form it may take.

With the growing adoption of blockchain-based solutions and challenger banks, it’s logical to assume that money is simply being redefined, taking another iteration to become more convenient and accessible and unite banking and web3.

Banking pillars – the emergence of EMI institutions

Banks have always been the backbone of the financial system, but they lag behind in adopting new technologies. On the contrary, challenger banks, EMI-licensed banking-as-a-service and on-off-ramp providers are realizing the true power of crypto and web3 technologies, letting users decide what kind of experience they own.

And as the most widely accepted form of money, fiat is one of the few layers that needs to be easily accessible for web3 to become mainstream.

In the long-term, crypto will not be separated from TradFi

The versatility of web3 attracts not only businesses but also end-users. The ability to seamlessly transition from one application to another with a full range of assets and capabilities creates a user-centric experience, allowing the ultimate ownership and control of your personal finances. With convenience and instant, permissionless access to any application, users are free to manage their digital money as they see fit.

Eventually, web3 will become a way for businesses to scale, but for this to happen, web3 needs transparent and smooth connections to financial transactions.

Fiat connectivity as the key challenge for growth

The main advantages of web3 are its open source, trustless and permissionless nature. However, despite these technological features, the environment hasn’t evolved as fast as it could have. Experts put forward many reasons, including unfavourable macroeconomic conditions, poor funding, and non-viability of web3 frontiers. The truth is that web3 solutions were never designed for ordinary users.

Poor fiat infrastructure, lack of direct connectivity to banking apps, and a general lack of awareness make the space inaccessible and generally intimidating for users. It’s extremely difficult even for traditional fintech to develop advanced compliance and payment mechanisms, and even more so for projects from the crypto space.

Payment solutions to scale web3 adoption

Since fiat money is the most trusted and widely accepted mode of transaction due to the developed financial infrastructure, it’s self-evident that platforms providing fiat bridges will become a fundamental layer in web3, helping in the transition from web2.

And it’s platforms that provide fiat gateways through widely accepted payment methods – debit and credit cards, Apple Pay and Google Pay, crypto-friendly IBANs – that will help reach new audiences beyond the existing crypto bubble.

The Fintech API for crypto

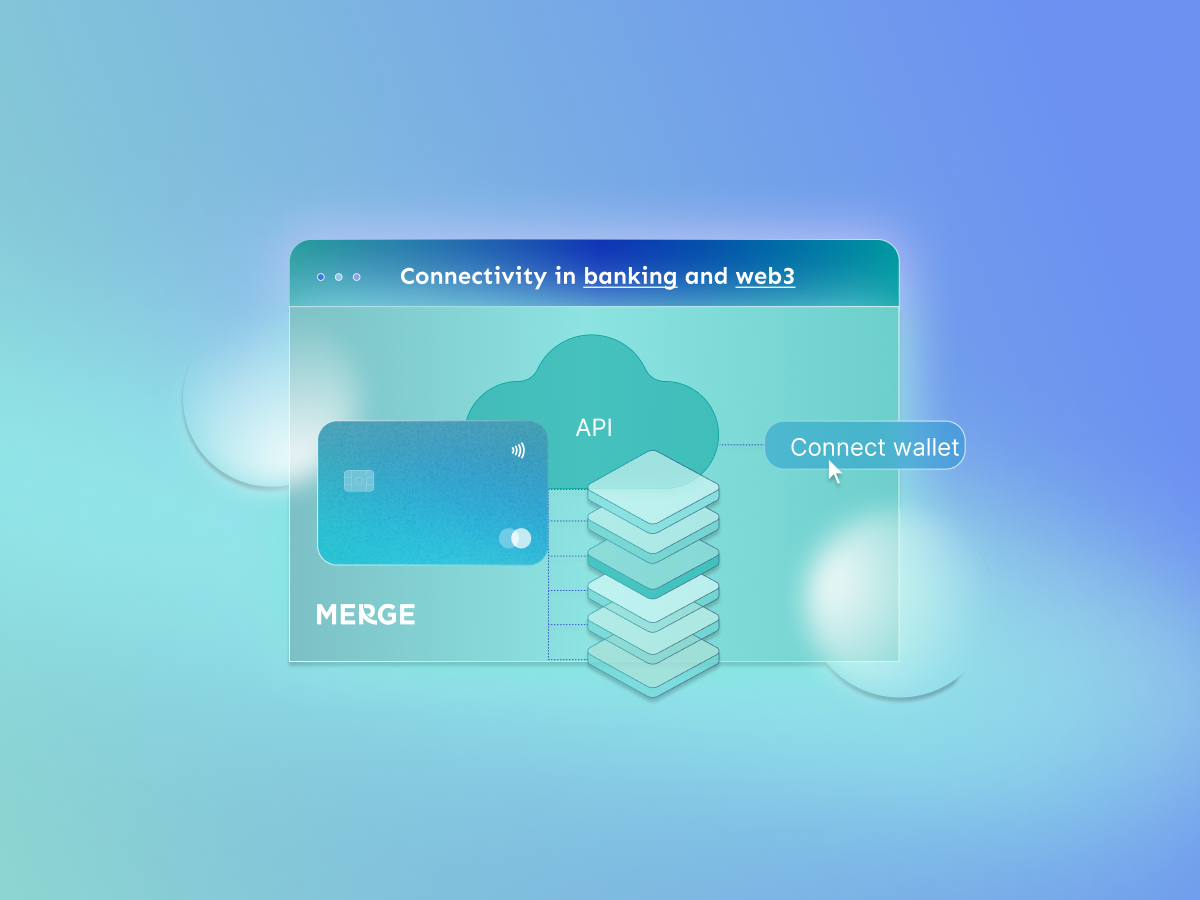

That’s where fintech APIs come into play as a convenient method to seamlessly improve the user experience without compromising the idea of decentralization.

Acting as a third-party fiat provider, fintech API solutions such as Merge become a powerful user acquisition channel. With the benefits of fiat connections and a crypto stack in one solution, users decide how they want to explore their web3 experience.

All-in-one payment and compliance stack

Since fiat onboarding solutions need to be seamless, developer-friendly fintech APIs have been designed to be integrated with a few clicks, allowing companies to focus on the crypto aspect of their business.

Integrating a ready-made API solution is all that companies need to ease the transition from fiat to web3. Whether it’s an instant crypto purchase, a convenient exchange integrated into the platform, or the issuance of a crypto-friendly bank account, the Merge fintech API provides solutions that can fit into any business use case. At the same time, we ensure that the process complies with regulatory requirements in order to eliminate risks for our clients.

Why now is the time to Merge

Winning user experience is the main element of competition between crypto platforms. And making fiat rails seamless is the key to securing turnover and expansion for web3 platforms, especially during a bear market.

That’s why we are building Merge. We aim to bridge the gap between traditional and digital assets, bring two separate worlds together, and help developers build and scale solutions for the new economy.

With our expertise in payments, banking, crypto, and founders who formerly worked at Coinbase, PayPal, and Barclays, we know how to help web3 attract and retain millions of users in the most compatible and efficient way.

Merge offers a solution that allows companies to connect to fiat railways and provide a crypto-friendly fiat account API. Want to have a chat? Reach out to hello@mergedup.com.